| CARVIEW |

The Institute on Taxation and Economic Policy

Trump 2025 Tax Law: Research and Resources

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

What's New

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

States Can Push Back Against Reckless Federal Tax Policy. Here’s How.

January 22, 2026 • By Aidan Davis, Wesley Tharpe

They should take steps to protect and boost their own revenues. And they should take a second look at their own tax cuts.

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

2025 saw an intensification of state and local tax fights across the country, as well as growing experimentation with local-option taxes, levies, fees, and tourism taxes aimed at keeping budgets afloat while also navigating political constraints imposed by state legislatures.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

Curbing Tax Deductions for Executive Pay is a Federal Tax Change States Should Get Behind

January 9, 2026 • By Matthew Gardner

This provision in last summer’s tax law could actually make budget-balancing a little bit easier for states if they follow suit.

ITEP in the News

Time: Americans Are Paying for Trump's Tariffs, Study Finds

Education Week: Schools Brace for Mid-Year Cuts as 'Big, Beautiful Bill' Changes Begin

MarketWatch: Tax the Rich in '26? These 3 Crucial Questions about Wealth Taxes Could Be Answered This Year

Associated Press: Georgia Republicans Move to Scrap State Income Tax by 2032 Despite Concerns

Newsweek: US Property Tax Changes Coming in 2026

ITEP Work in Action

North Carolina Department of Commerce: The Hidden Cost of Child Care Gaps in North Carolina's Economy

Joint Center for Political and Economic Studies: State of the Dream 2026: From Regression to Signs of a Black Recession

New Jersey Policy Perspective: Five Budget Time Bombs Facing the Next Governor

Washington Governor's Office: Governor Ferguson Announces Support for Millionaires’ Tax

Kentucky Center for Economic Policy: In New Poll, Kentuckians Say Income Tax Cuts Aren’t Helping

Across the States

On the Map

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to…

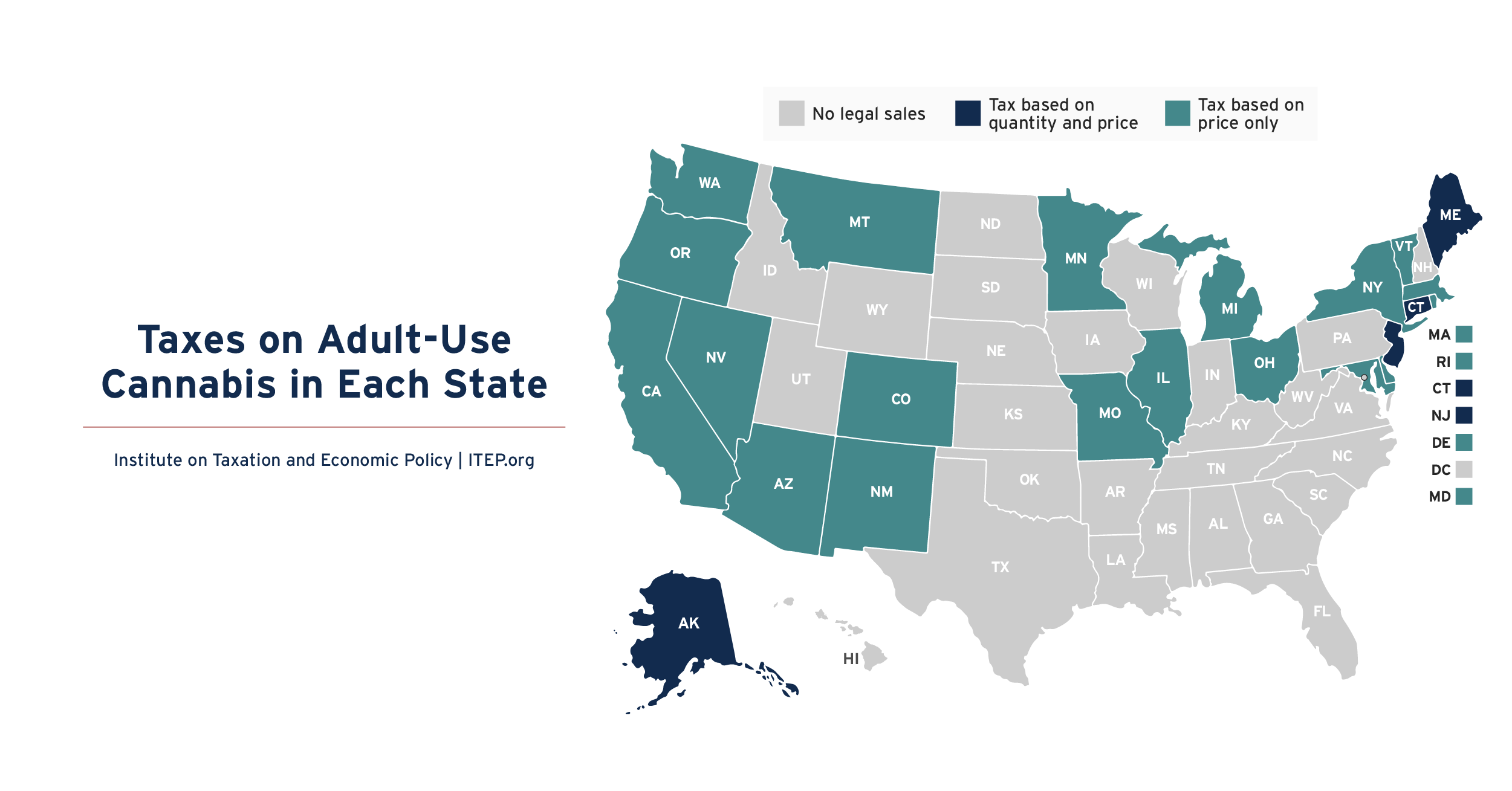

Taxes on Adult-Use Cannabis in Each State

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on…

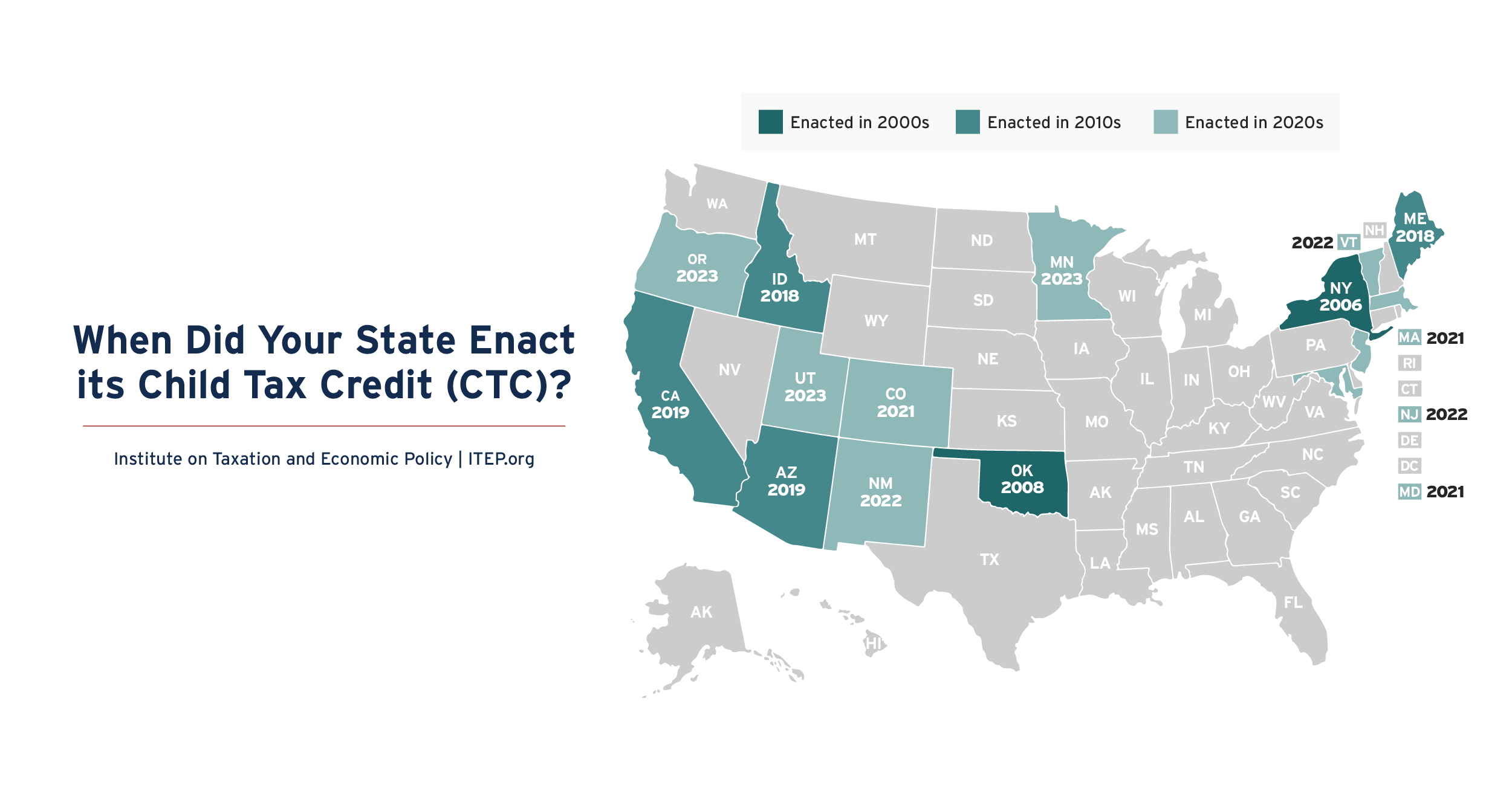

When Did Your State Enact a Child Tax Credit?

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also…

State & Local Tax Policy

States Can Push Back Against Reckless Federal Tax Policy. Here’s How.

January 22, 2026 • By Aidan Davis, Wesley Tharpe

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

Curbing Tax Deductions for Executive Pay is a Federal Tax Change States Should Get Behind

January 9, 2026 • By Matthew Gardner

Show Me Where We're Going: Missouri’s Fiscally Irresponsible Path Will Be Paid for by Everyday People

January 8, 2026 • By Logan Liguore

Pennsylvania Just Gave Low-Income Workers a Tax Credit Boost. Now It’s Philadelphia’s Turn.

December 30, 2025 • By Kamolika Das

2025: The Year in Tax Policy

December 23, 2025 • By ITEP Staff

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

Texas Property Tax Plan Mimics California’s Damaging Prop 13

December 19, 2025 • By Neva Butkus, Rita Jefferson

The ITEP Guide to State & Local Taxes

The ITEP Guide to State & Local Taxes offers citizens, advocates, journalists, and policymakers a detailed primer on state and local tax policy. Learn more about the three main sources of revenue (income, property, and sales) and the major principles that shape tax codes and discussions.

Tax Principles

Income & Profits

Property & Wealth

Sales & Use

Other Revenues

Expert's View

Carl Davis

Research Director

The Geographic Distribution of Extreme Wealth in the U.S.

Excessive concentration of wealth runs counter to our national aspiration for genuine equality of opportunity, and it saps the vitality of our democracy through the consolidation of power and influence. Tax policy offers a powerful means of beginning to address our nation’s stark level of inequality, but current law is clearly falling short of its potential.

– Carl Davis

Research Director

Steve Wamhoff

Federal Policy Director

Washington Post: Trump’s tax law includes a $40,000 SALT cap. Here’s who qualifies.

SALT cap or no SALT cap, the mega bill overall is a bonanza for the rich in every state.

– Steve Wamhoff

Federal Policy Director

Kamolika Das

Local Policy Director

USA Today: Would Mamdani’s ‘Millionaire Tax’ Chase the Rich Out of New York City?

Tax policies just really don’t drive relocation decisions, they’ve been claiming this for a long time, and there’s just very scant evidence to support it.

– Kamolika Das

Local Policy Director

Miles Trinidad

State Analyst

CT Mirror: Sales tax holidays under fire as CT launches its promotion

A two- to three-day sales-tax-free shopping spree for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year.

– Miles Trinidad

State Analyst

Institute on Taxation

and Economic Policy

ITEP is a non-profit, non-partisan tax policy organization. We conduct rigorous analyses of tax and economic proposals and provide data-driven recommendations to shape equitable and sustainable tax systems.

Subscribe to ITEP Emails

Tax research and policy news in your inbox.

Promote Fair Tax Policy

Your gift to ITEP promotes tax justice. With your help, we do research that supports taxing millionaires and billionaires, taxing big corporations and raising revenue for the things our people, our communities and our planet need.

Together, we can create a country with more economic justice, more racial justice, more climate justice… and more tax justice.

Federal Policy Research

State Policy Research

Local Policy Research

Contact

Washington, DC 20036

© 2026 Institute on Taxation and Economic Policy. All rights reserved.

Subscribe to ITEP Newsletters

Cookie Preferences

We use a Google Analytics cookie to understand how people use our site.