| CARVIEW |

Menu

- About

- News

- Services

- Investor Relations

- Sustainability

- CyberAgent Way

Menu Top

Menu Top

Menu Top

- Investor Relations Top

- Message from CEO

- Growth Strategy

- Competitive Advantage

- IR Library

- IR Channel

- Dividend・Stocks

- IR News

- IR Calendar

- Awards

- Analyst Coverage

- FAQ

Menu Top

- Sustainability Top

- Environment

- Society

- Governance

- Security

- Safety

- Human Capital

- ESG Data

- SDGs

- Sustainability News

Menu Top

Sustainability

Sustainability

About

Services

Sustainability

- Sustainability Top

- Sustainability at CyberAgent

- SDGs

- Environment

- Society

- Governance

- Security

- Safe and Sound Services

- Human Capital

- ESG Data

- Sustainability News

Official Owned Media

Search

Dividend

We aim to mid to long term increase the stock price and pay dividends consistently.

Dividend Policy

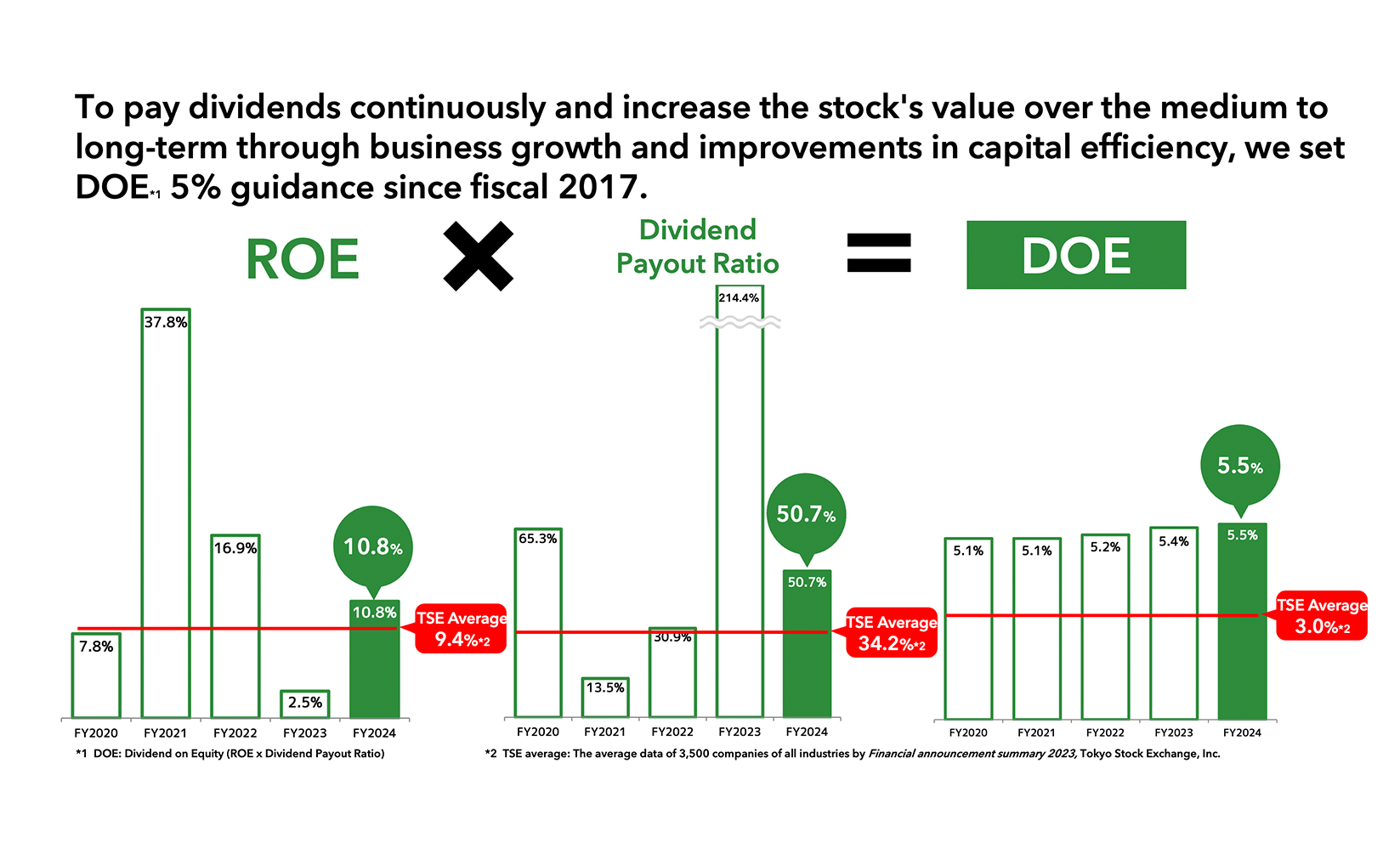

CyberAgent considers the return of earnings to shareholders to be a top management priority. In addition to increasing the stock's value over the medium to long-term through business growth and improvements in capital efficiency, we intend to pay dividends continuously. Therefore, we set DOE of 5% or more as a management guidance in fiscal 2017.

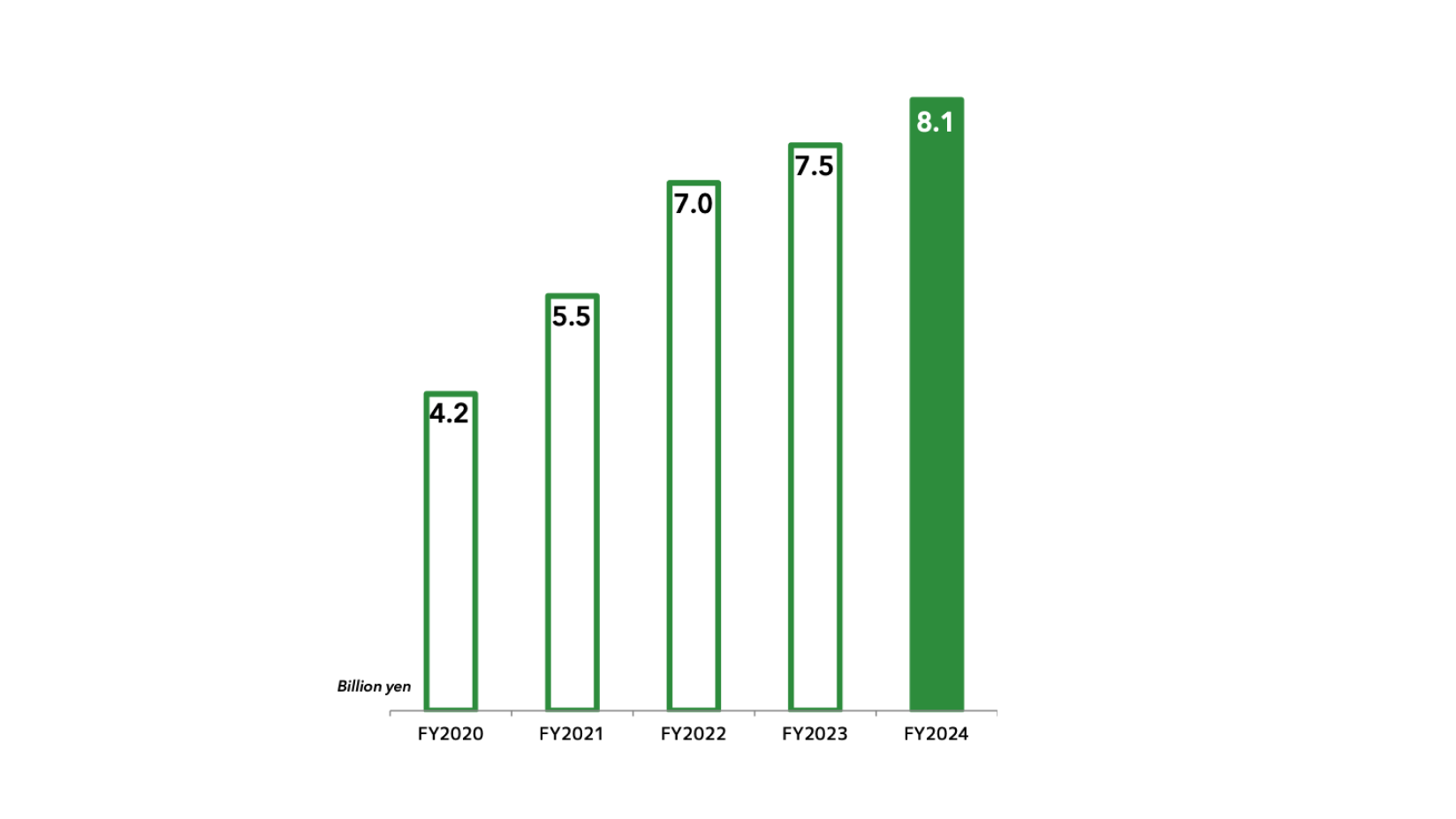

Year-end Dividend

According to the DOE 5% management guidance, the year-end dividend for FY 2024, ended September 2024, rose to 16 yen. The FY 2025 dividend forecast is set at 17 yen.

| Fiscal Year | Dividend per Share |

|---|---|

| FY2025 | 17 yen |

| FY2024 | 16 yen |

| FY2023 | 14 yen |

Dividend History and Forecast

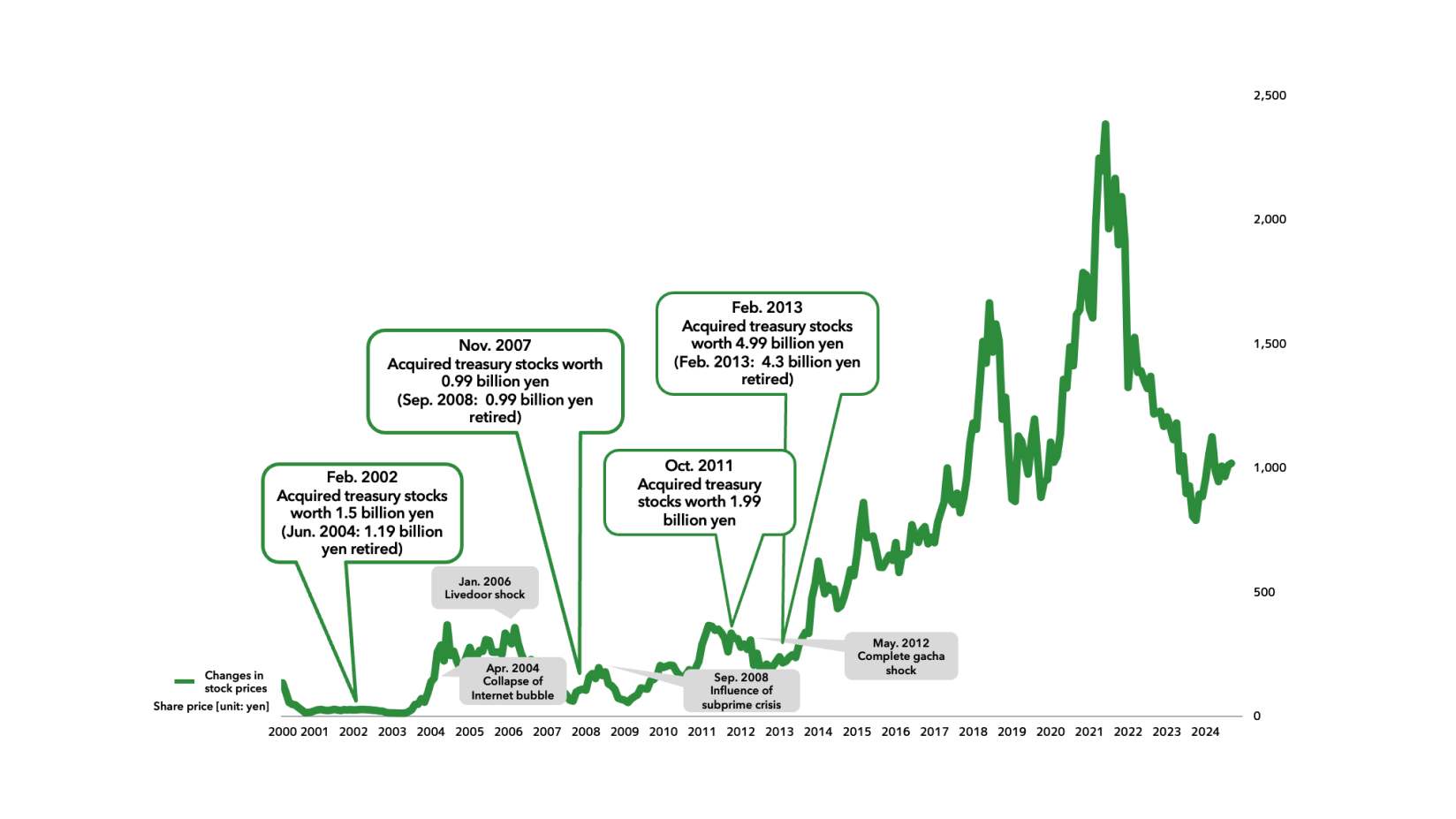

Share Buyback and Cancellation

We had implemented four share buybacks and cancellations in the past.

| Transaction Period | Purchase Method | Amount |

|---|---|---|

| to | Purchase in the open market | 4.99 billion yen |

| to | Purchase in the open market | 1.99 billion yen |

| to | Purchase in the open market | 0.99 billion yen |

| to | Purchase in the open market | 1.5 billion yen |