Deploy pricing agility for efficient rating strategies

Transform your underwriting process into a strategic advantage

In today’s fast-evolving insurance landscape, staying competitive without compromising profitability is a constant challenge. Our Pricing solution is designed to help you master this balance by transforming your underwriting process into a strategic advantage.

From advanced data preparation to pure & commercial premium valuations and customer behavior analysis, our Pricing business app covers the entire technical pricing value chain. It integrates insurance market models, pricing workflows, and insurance price optimization techniques to help your teams make smarter and faster decisions, and to ensure that your company achieves an optimal competitive positioning.

FEATURES

Our pricing solution for insurance experts

We guide your journey to success by enhancing the global value chain of your Pricing process. While you’ll receive comprehensive support from our teams to swiftly become operational, our Pricing solution will make of you a pricing expert in less than six months. This solution incorporates all the best pricing practices and methods, ensuring that this expertise is effectively transferred to your teams.

As your actuarial teams utilize the Pricing Business App more extensively, they will continuously enrich their know-how and experience.

Flexible integration of policies/claims data

Creation of new variables, merge with other files, full traceability of the transformation of the data.

Dynamic data understanding process

Claims Empirical distribution, large losses identification, one way and two-way analysis, rating factor correlations.

Enhanced GLM framework

Statistical testing & stepwise, splines, Polynomial regression, variables interaction, fine tuning with machine learning algorithms, geospatial smoothing.

Tailored consolidation & impact analysis

Direct application of rating structure on data, scenario management, reporting.

State-of-the-art model assessment

Model comparison, lift curves & model efficiency KPIs (e.g.: Gini), time consistency, out-of-sample performance.

Data-driven decisions

Utilize advanced algorithms to accurately assess risk and optimize pricing. Gain insights into customer behavior and market trends to inform your pricing strategies.

From technical price to commercial price

Demand model, price elasticity definition, scenario testing efficiency frontier.

Complete control

Manage and track every change to your pricing strategies. Unify your pricing strategy and maximize profitability.

Rating system

Deploy pricing models using our real-time rating system. Key features include model versioning and repository, user and permissions management, production dates and calling rules. We ensure a secure, flexible and efficient integration into your core systems.

THEY TRUST US

What insurers say about Addactis

OVERVIEW

Position your pricing approach at the heart of your underwriting, growth and profitability strategy

Watch the video below and find out more about how addactis® Pricing Live can elevate your Pricing strategy.

THE ADDACTIS PLATFORM

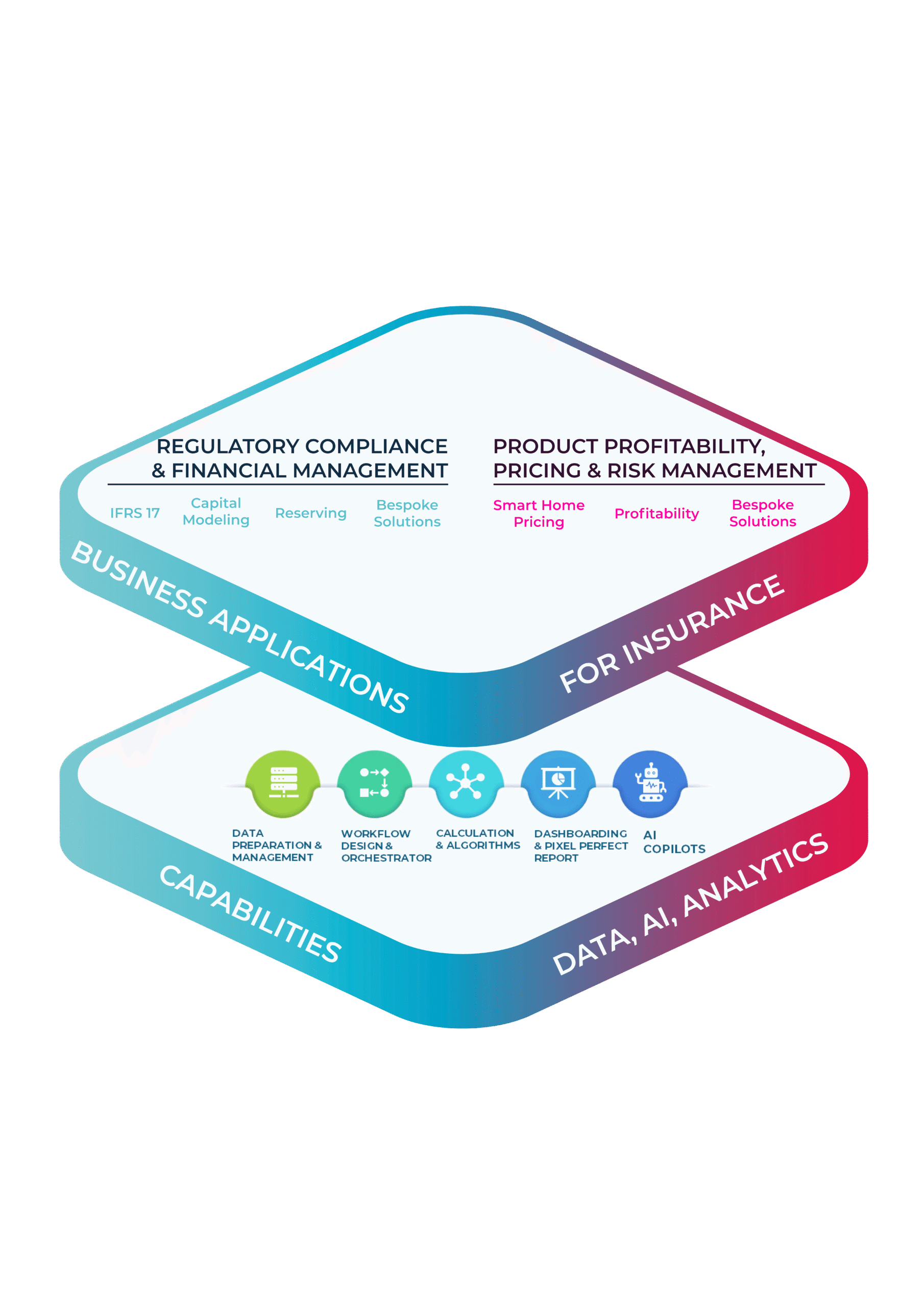

Our business app is part of the next-generation Actuarial Risk Management Platform

Our comprehensive SaaS platform is designed to transform and accelerate the development and customization of insurance solutions. Whether you specialize in Life insurance or non-life insurance, our platform promises to deliver substantial business value and operational efficiency.

Experience unparalleled reliability, efficiency, and innovation with a system crafted to meet the dynamic needs of the insurance industry. Elevate your business operations today and stay ahead of the competition with our unique, cutting-edge solution.

Our platform is the only one on the market that seamlessly addresses both regulatory and profitability scopes, ensuring your success in a highly competitive landscape.

A unique and unified actuarial platform, designed to ensure compliance and profitability, through a range of business applications.

Thanks to the Addactis Platform, the Pricing solution is connected to other business applications.

RESOURCES

Explore our content related to Pricing

Find out more about our Pricing expertise by reading the analyses and insights regularly published by our experts.

Demystifying Credibility Theory: its impact on Insurance Pricing

This article dives into how credibility theory helps smooth geographical risk factors in insurance pricing.

Six key challenges for a non-life pricing insurer

Discover the six key pricing challenges that are common across all types of non-life insurance companies.

Navigating the complexities of Insurance Pricing: Modeling, Climate Risks & Large Losses

Learn more about the use of data for more precise predictions, the role of regulatory compliance in shaping pricing strategies and more through our presentation.

FAQ

More about Pricing

What are the key features of our Pricing Business App?

The solution offers comprehensive tools for P&C and Life & Health pricing, underwriting, and price optimization. It supports data analytics, ratemaking, profit testing, and digital marketing to enhance the value chain of your underwriting process.

What does the end-to-end pricing workflow include?

How does the Pricing Business App ensure compliance with regulatory standards?

Our Pricing solution includes features that comply with new technical standards from regulators, supporting transitions to multivariate techniques and ensuring that your pricing processes are both auditable and regulator-certified.

How does the Pricing solution integrate customer behavior into pricing strategies?

What features does the rating system include in the Pricing App?

Can the Pricing solution support us in reviewing and streamlining our pricing strategy?

Absolutely. In today’s increasingly competitive market, rethinking your pricing strategy often requires a fresh look at your processes. The Pricing solution includes expert support, collaborative guidance and training sessions to help you drive change and lead this transformation with confidence. You will benefit from market best practices and our extensive R&D expertise to refine your pricing approach and processes.

What are the key steps in achieving pricing sophistication with Addactis?

Addactis guides you through a 5-step journey to pricing sophistication:

-

- Technical pricing base-camp: Centralize and optimize data access for clarity and reliability.

- Customer behavior & price simulation: Use price elasticity functions to better understand customer responses at renewal or conversion.

- Business interaction: Run scenario testing and impact analysis to get the KPIs you need for effective and informed decision-making.

- Innovation & agility: Deploy new rating structures faster with the Pricing Live API, reducing time-to-market and empowering business teams.

- Expert coaching: Benefit from a complete coaching program to build autonomy and deepen your team’s expertise.

Contact us to know more about the program.

Premium contents

Personal data protection Charter

Partner Program

addactis® is a registered trademark, property of ADDACTIS Group SA, used by our companies to market their service offering.

©2025 - ADDACTIS Group - all rights reserved